Studying the Art of Seamless Payments: Some sort of Guide for Businesses

In typically the fast-paced world involving business, mastering the ability of seamless payments is really a crucial aspect to be successful. Click to find out more is at the coronary heart of any purchase, making it essential for businesses to know, optimize, and influence this fundamental method. Whether you're the small start-up or perhaps an established business, the way a person handle payments may greatly impact your operations, customer satisfaction, and overall main point here.

Through the basics of payment running to navigating the intricate regarding costs, security, and technologies, this comprehensive direct is designed in order to equip business proprietors with the knowledge and tools required to make informed choices and smart alternatives in terms of payment control. Having a focus on practical tips, cutting edge trends, and real-life examples, this informative article aspires to demystify the complexities of repayment processing while leaving you businesses to reduces costs of operations, enhance effectiveness, and stay forward in an more and more digitized marketplace.

Understanding Transaction Processing Basics

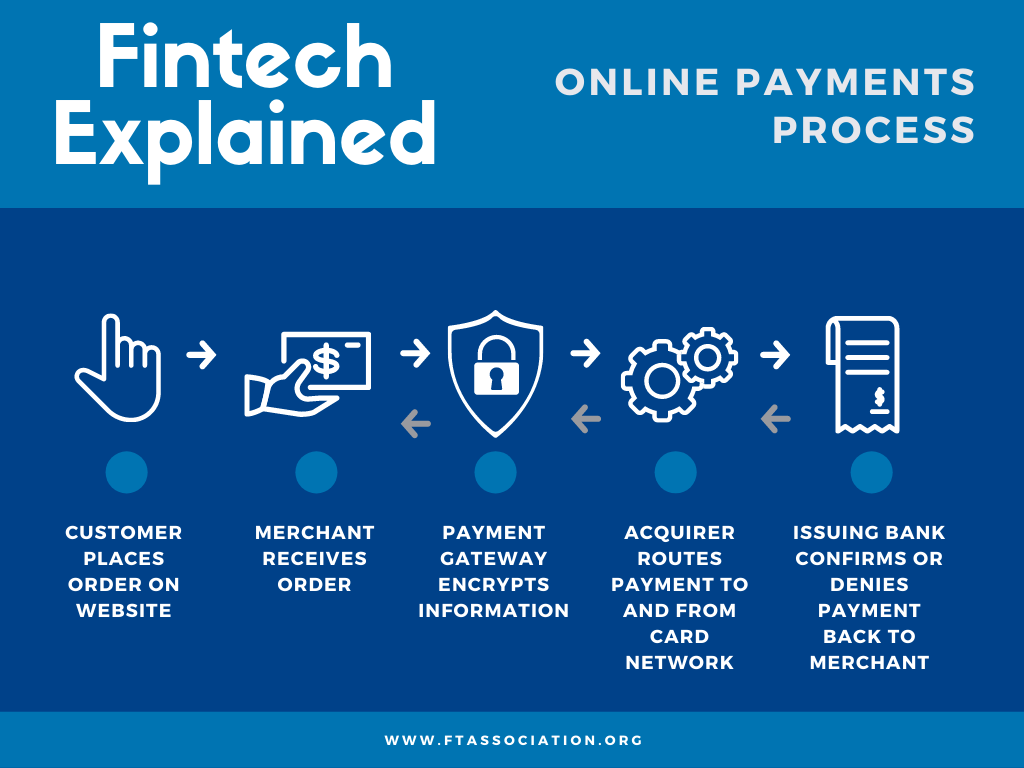

Payment processing is really a crucial element of any business operation, relating to the transfer of funds involving a customer and a merchant. It commences when a customer initiates a purchase through a transaction method, such because charge card, debit cards, or digital finances. The transaction details is then securely transmitted for the payment cpu for verification and even approval.

Once the payment processor receives the transaction details, it communicates with all the relevant economic institutions in order that the availableness of funds and approve the transaction. This process usually includes fraud diagnosis measures to offset risks and shield the two customer and the merchant by unauthorized transactions. As soon as the transaction qualifies, the funds are really transferred from the particular customer's account in order to the merchant's accounts, completing the transaction process.

In essence, payment processing operates seamlessly behind the views, allowing businesses to be able to accept various repayment methods and providing customers with a new convenient and safeguarded method to make buys. Understanding the principles of payment running is essential regarding businesses to boost their payment moves and provide a positive experience for their particular customers.

Selecting the best Payment Processor

Any time it comes in order to choosing the right payment processor chip for the business, right now there are several key factors to think about. First and most important, measure the needs of your business, such as transaction volume, types of obligations accepted, and the usage requirements.

Secondly, research the reputation and dependability of various payment processors. Look for providers using a reputation secure dealings, excellent customer support, and competitive charges.

Finally, don't forget to measure the scalability regarding the payment cpu. As your company grows, you'll need a provider that can easily scale with you plus adapt to virtually any changes in your transaction processing needs.

Future Developments in Payment Control

In the rapidly evolving landscape of transaction processing, several essential trends are shaping the future regarding transactions. One well known trend is typically the rising adoption of mobile payment processing solutions, enabling buyers to make smooth transactions using their smartphones or other portable devices. This kind of shift towards mobile payments offers convenience and flexibility, wedding caterers to the improving demand for on-the-go dealings within a digital-first globe.

An additional significant trend in the horizon may be the integration of artificial intelligence and machines learning technologies in to payment processing systems. By leveraging AJAI algorithms, businesses may enhance fraud detection capabilities, personalize buyer experiences, and boost payment processes with regard to increased efficiency. Seeing that AI continues to advance, we might expect payment processing systems to turn into more intelligent and even adaptive, streamlining deals and improving safety measures.

Furthermore, the climb of blockchain technologies is poised to be able to revolutionize the approach payments are prepared, offering enhanced openness, security, and productivity. With Click here for more decentralized ledger system, blockchain ensures the ethics of transactions although reducing dependency in intermediaries. As blockchain continues to gain traction in typically the payment industry, businesses are exploring it is potential to enhance cross-border payments, reduce transaction costs, plus provide a protected foundation for the future regarding payment processing.